Get Active in Our Amazing Community of Over 451,000 Peers!

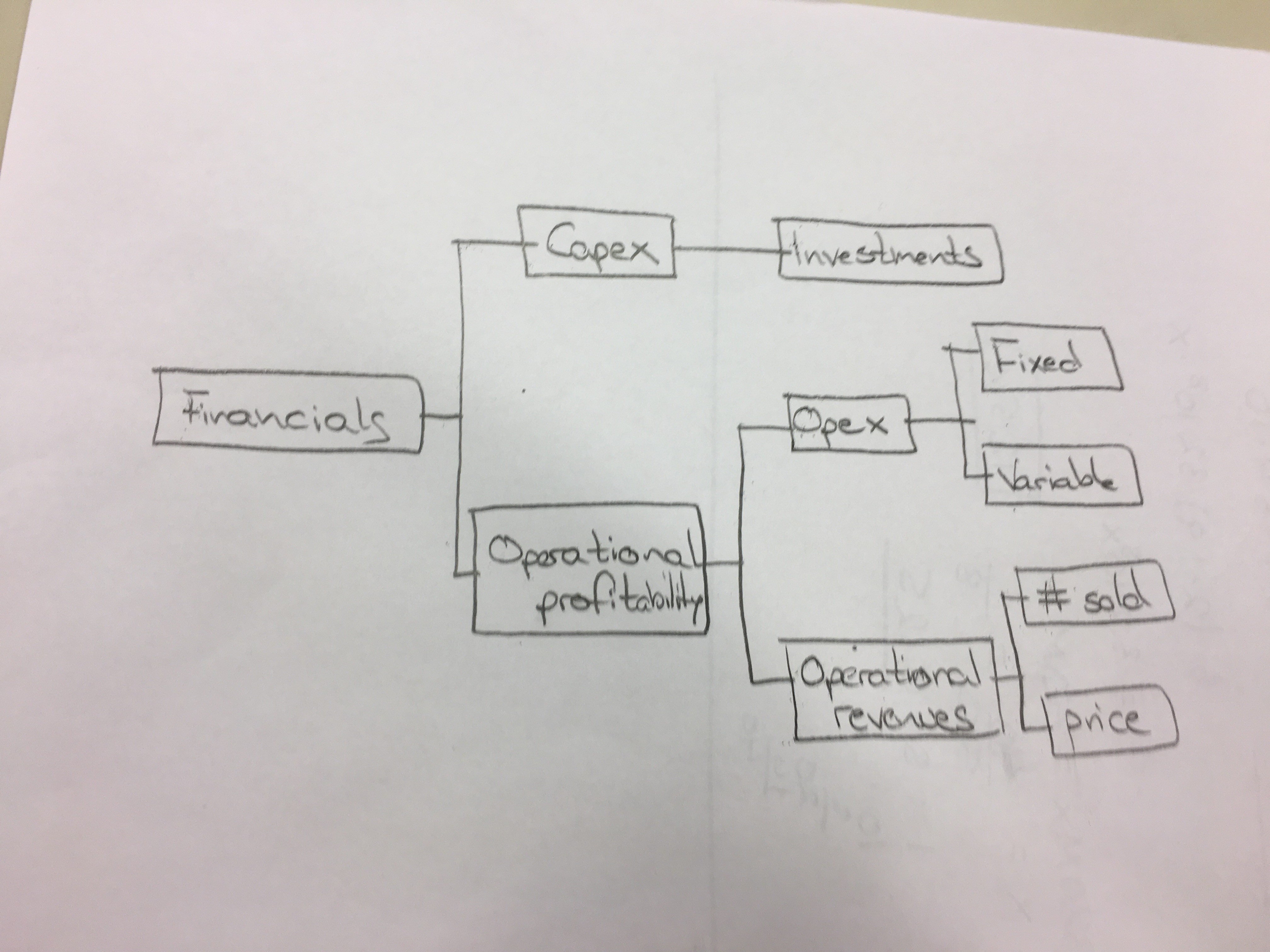

Is this a fair structure for the financial part of an investment related case?

Overview of answers

Hi Anonymous,

that's a good start. But it is somewhat incomplete and lacks precision especially around terminology.

What is the key question you need to answer in an investment case?

"Is this a good investment?"

The way to answer this question is usually to see if all future cash flows resulting from the investment actually recuperate the initial investment. And because a cash flow 10 years from now is a lot less nice than the same cash flow today, we discount. Et voilà, we have the discounted cash flow method (DCF).

So what you want to come up with is the sum of all future discounted cash flows - the Net Present Value (NPV). That should be all the way to the left.

Then you need the discount rate (= WACC) - that's one branch of the tree.

And then you need cash flows (EBITDA should do as a proxy) - that's the second branch. Of course, that one breaks down into Revenues (scratch the "operational"! Because that's - literally - a written invitation to probe you for "non-operational revenues". That fun could be avoided, unless you want to lay the breadcrumbs there because you're an accounting wizard, which your tree honestly doesn't suggest.) and costs.

Now, many people have a problem in thinking in cash flows, so I guess it would be permissible to break out the initial investment in a separate branch (similar to your capex branch). Even if technically it is only a cash flow which just happens to be at the very beginning and be particularly large.

Hope this helps.

E

(edited)