Hello,

A logistics company has to choose between "standard trucks"(ST) and "hybrid trucks"(HT) and has the following data:

----------------------------------ST------------------------HT

1. Purchase price: ____$100k___________$150k

2. Maintenance/Yr: _____$5k_____________$8k

3. Insurance/Yr:________$2k_____________$3k

4. Fuel/Yr:______________$18k____________$9k

5. Lifespan: ____________10 Yrs__________10 Yrs

6. Depreciation/Yr: _____$10k____________$15k

So far:

operating costs = $35k/Yr for both ST & HT (maintenance + insurance + fuel + depreciation)

op costs for 10 yrs = $350k for the 10Y lifespan

In this case, depreciation is the annualized cost (used value of the asset) which after the 10Y period will be less than the initial price.

100k in Year1 > 10k from Y1 to Y10, so depreciation cannot include financing/loan premiums.

How do we include the full purchase price (initial investment or financing fees) in the total investment required while still having the depreciation in mind?

Thank you for answering, cheers!

LE:

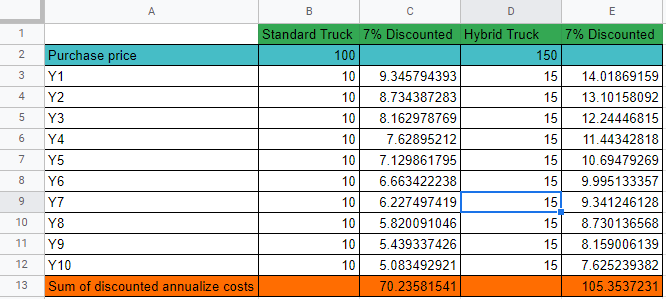

So basically, the depreciation accounts for way less than the purchase price (assuming a 7% discount rate for future cash flows)

(edited)

Agree with you that the cash flow is the best approach. What about the table? Depreciation is less than the purchase price.... How can you solve that?