Can someone please explain the break even calaculation?How is it 15 years?

Get Active in Our Amazing Community of Over 451,000 Peers!

Break even calculation

Overview of answers

Hello!

Precisely for the high amount of questions (1) asked by my coachees and students and (2) present in this Q&A, I created the “Math & Formulas - Economic and Financial concepts for MBB interviews”, recently published in PrepLounge’s shop (https://www.preplounge.com/en/shop/prep-guide/economic_and_financial_concepts_for_mbb_interviews).

After +5 years of candidate coaching and university teaching, and after having seen hundreds of cases, I realized that the economic-related knowledge needed to master case interviews is not much, and not complex. However, you need to know where to focus! Hence, I created the guide that I wish I could have had, summarizing the most important economic and financial concepts needed to solve consulting cases, combining key concepts theorical reviews and a hands-on methodology with examples and ad-hoc practice cases.

It focuses on 4 core topics, divided in chapters (each of them ranked in scale of importance, to help you maximize your time in short preparations):

- Economic concepts: Profitability equation, Break even, Valuation methods (economic, market and asset), Payback period, NPV and IRR, + 3 practice cases to put it all together in a practical way.

- Financial concepts: Balance sheet, Income statement/P&L and Performance ratios (based on sales and based on investment), +1 practice case

- Market structure & pricing: Market types, Perfect competition markets (demand and supply), Willingness to pay, Pricing approaches, Market segmentation and Price elasticity of demand, +1 practice case

- Marketing and Customer Acquisition: Sales funnel, Key marketing metrics (CAC and CLV) and Churn, +1 practice case

Feel free to PM me for disccount codes for the guide, and I hope it helps you rock your interviews!

Hello Ameja,

Can you specify what are your doubts?

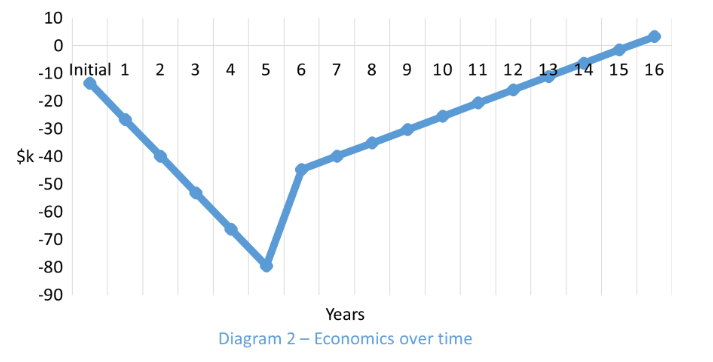

I will try to clarify the solution dividing the calculation in 4 steps, (you can have a look at the graph in the bottom):

- Initial investment: 12k$ for investment bottles and 1500$ for drinking bottles, 13500$ totally Cumulative return: -13500$

- First 5 years: no revenues from selling bottles. As costs we have monthly $300 for purchase of drinking wine, $600 for investment wine, and $200 for maintenance of the cellar. In total 12*1100$=13200$ per year Cumulative return: -13500$ - 5* 13200$= -79500$

- End of 5th year: selling of the initial stock. Per each bottle we receive $100*(1 + 20%)^5=250$ (approximately). We have an inital stock of 120 investment bottles, so 120*250$=30k$ Cumulative return: -79500$ +30000 $ =-49500$

- Starting from 6th year: Costs stable at 13200$ per year, revenues of 72*$250=$18,000. We have a net return of 4800$ per year. Years needed to break even: - 49500$ / 4800$ = 10.3 years. So we have that we will have a positive cumulative return starting from year 16 (15 years after).

Feel free to contact me for further discussion.

Hope it helps,

Luca

Yes, so after the 5th year he will start to earn money! The Profit will be appx. 5,000€, if you deduct the 30,000 profits from the initial stock, there is left 50,000 of the investment (appx 80,000 - 30,000= 50,000)! So, he needs 10 years to break even + the first 5 years, in total of 15 years!

Can you be more specific on your question?

It is 15 years as the cumulative profit turns from negative to zero in year 15.