Hi Anonymous!

I believe the first structure is a better starting point. However, it still needs significant improvement.

Structuring a case does not primarily mean to explain the interviewer WHAT you want to look into (the "buckets")! Structuring a case primarily means to explain the interviewer HOW you are going to answer the specific question that has been asked!

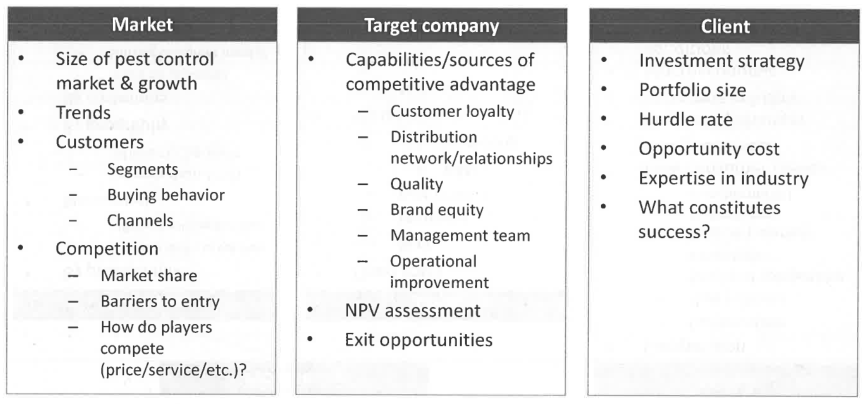

So your structue needs to be a LOGIC, not a set of qualitative buckets! Such qualitative elements (Customers, Market, Product, Competition, etc.) are nothing more than influencing factos that determine the answer to the question THROUGH the logic that you have outlined. This is how you think as a strategy consultant, and this is how you work out the approach towards strategic problems on real engagements. And you might not be surprised that this is also by far the best way to approach case questions in a rigorous way.

So the most important part you need to verify in such a case is whether the strategic move (the acquisition) will help reach the client's objective. If this objective is of financial nature (e.g., profit), then your structure needs to verify whether the target profit increase can be reached or not. This is operationalized by a clear criterion according to which the answer to the client's question is YES or NO. For example, it could be:

"If the additional profit generated by the acquisition exceeds the corresponding investment costs by at least 25% (the required return; to be verified with interviewer) over X years (the investment horizon; to be verified with interviewer), then it makes financial sense."

--> [additional yearly profit] x [investment horizon in years] > [investment cost] x 1.25

This is the core part of the structure - the financial analysis. You then need to quantify the elements of this inequality and check whether the inequality can be met or not. This is usually done by driver trees to which you then attach the typical qualitative buckets as outlined in your second structure.

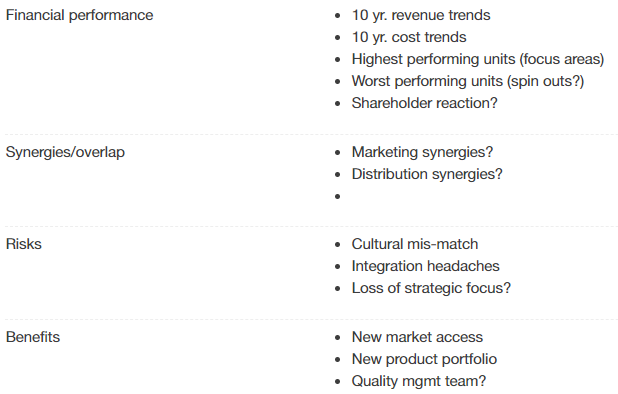

But it does not make sense to have a seperate bucket like synergies on the same level as financial analysis, since synergies drive the financial analysis! The same is true for what you call "Benefits". These need to sit on a deeper logical layer, since they influence the financial result. The other elements such as capabilities and risks are side conditions which you also need to outline in the beginning, but they will not be the main focus of the analysis and usually only get scrutinized towards the end of the case to outline next steps/additional analysis required.

Cheers, Sidi

(editiert)