Hi,

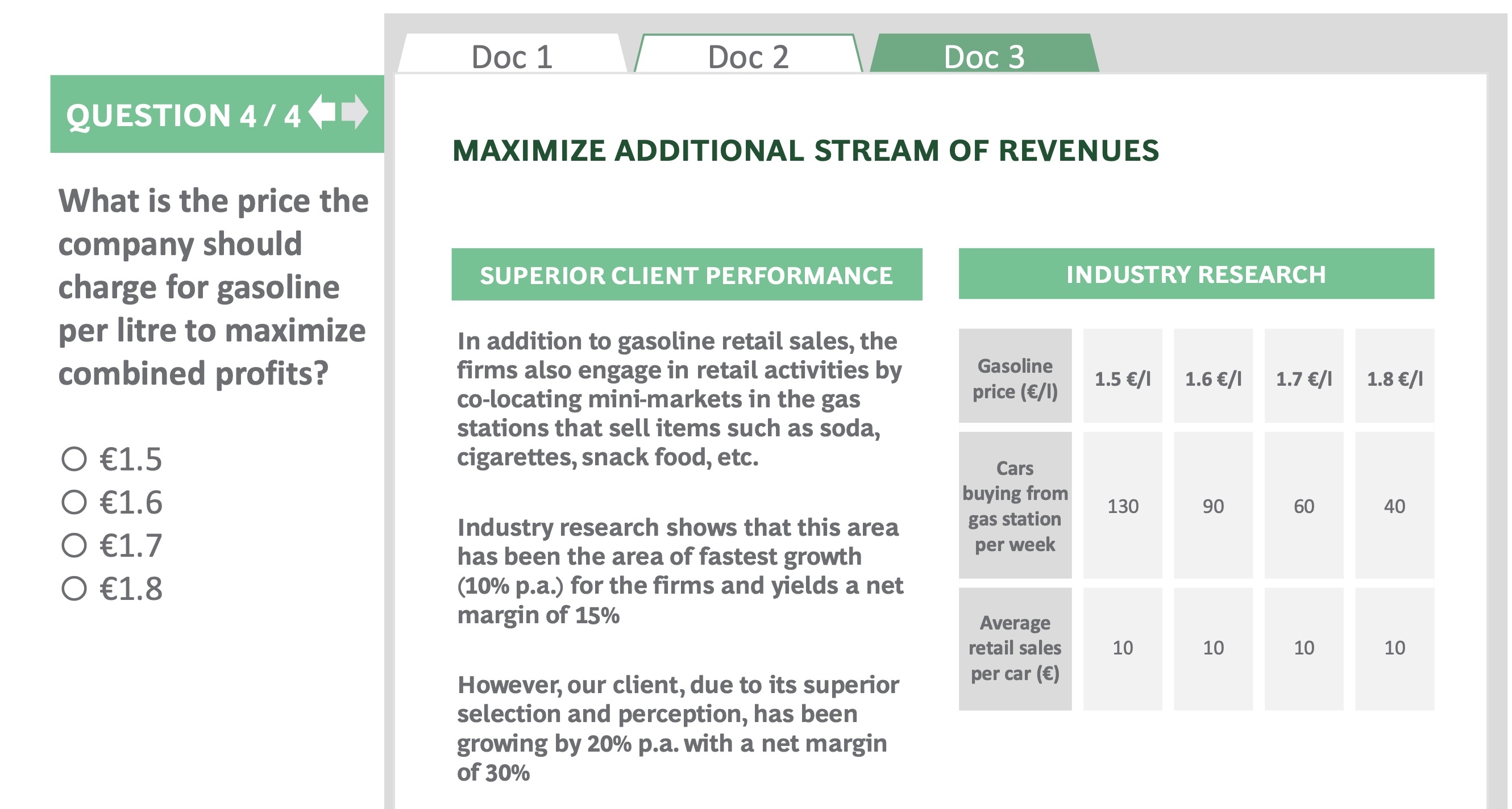

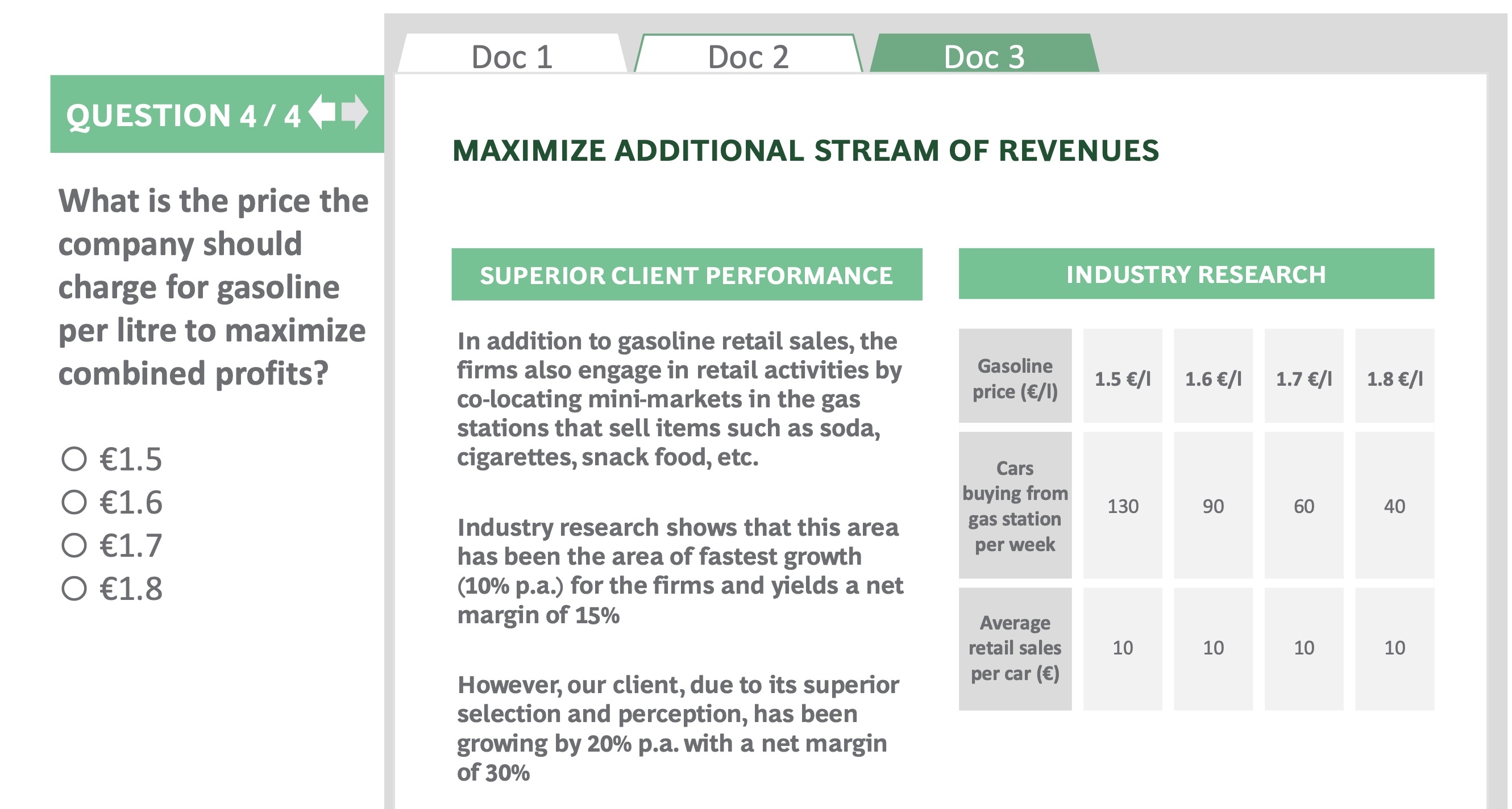

Can someone help me answer this question? The answer is 1.6 but I'm not sure how they came to that.

Hi,

Can someone help me answer this question? The answer is 1.6 but I'm not sure how they came to that.

It’s simple. The ask is to maximize the combined profits. Since margins are same, you need to figure out the price at which sales are maximized (cars per week x retail sales x average price). this price is 1.6

hope this helps

good luck

With the information you provided we are only able to calculate the probitability of the retail operation, but not the profitability from fuel sales.

Erfahre alles über BCG Online Case und wie du dich damit auf dein Job-Interview bei der Boston Consulting Group oder einem anderen Unternehmen bewerben kannst!

??? It is necessary to use info from the previous question that gives both margins per liter and liters sold at different prices.

I think there is more information to it? Just examining the table on the slide the 40 extra cars would be the most profitable. I guess something about margins regarding the fuel prices?

Based on that isn't it (1.5 x 130 x 10) = 1950 for the 1.5 price and then (1.6 x 90 x 10) = 1440 for the 1.6 price? So how is 1.6 the better price?