Die Gewinn- und Verlustrechnung ist ein wichtiger finanzieller Leistungsindikator

Die Gewinn- und Verlustrechnung (GuV) ist eine Zusammenfassung der jährlichen Einnahmen, Kosten und Gewinne/Verluste sowie neben der Bilanzierung und der Kapitalflussrechnung einer der drei Finanzindikatoren.

Im Gegensatz zur Kapitalflussrechnung werden in der Gewinn- und Verlustrechnung Erträge und Aufwendungen zum Zeitpunkt der Abgrenzung erfasst. Wenn ein Unternehmen z. B. eine Rechnung erhält, wird diese in der Gewinn- und Verlustrechnung des Unternehmens an dem Tag ausgewiesen, an dem die Rechnung entstanden ist. In einer Kapitalflussrechnung werden die Kosten erst dann als Auszahlungen verbucht, wenn die Rechnung tatsächlich bezahlt wird.

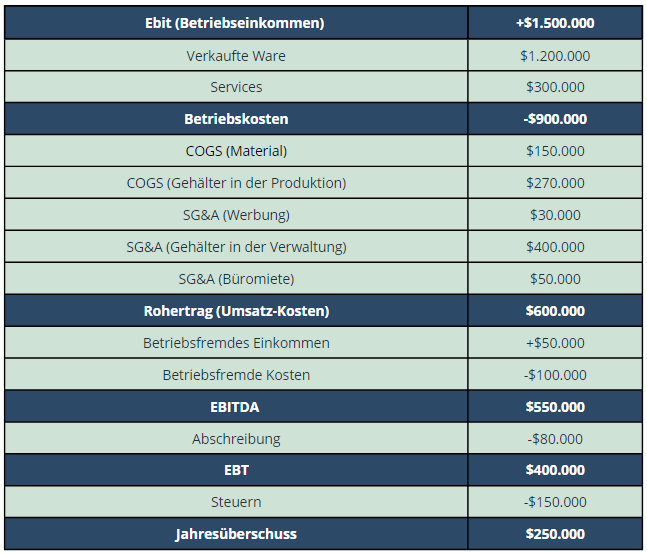

Im Folgenden sind einige gängige Begriffe aus der Gewinn- und Verlustrechnung aufgeführt

- Betriebseinnahmen beziehen sich auf alle Einnahmen, die im Rahmen der regulären Geschäftstätigkeit eines Unternehmens erzielt werden

- Die Betriebskosten werden in Wareneinsatz (Costs of goods sold, kurz COGS) und Vertriebsgemeinkosten (Kurz SG&A) unterteilt. COGS werden direkt durch die Produktion von Waren verursacht, z. B. durch Materialkosten oder den Arbeitsaufwand. SGA bezieht sich auf Kosten, die sich nicht ohne Weiteres einem einzelnen Produkt zuordnen lassen, wie z. B. allgemeine Markenwerbung. Diese Kostendifferenzierung ist analog zu den fixen und variablen Kosten

- Der Rohertrag ist der Betriebsertrag abzüglich der Betriebskosten, die sich aus dem Kerngeschäft eines Unternehmens ergeben

- Betriebsfremde Einnahmen und Kosten sind nicht geschäftsbezogene Einnahmen und Ausgaben, wie z. B. Einnahmen aus dem Verkauf von Immobilien oder Kosten für einen Rechtsstreit

- Abschreibungen bezeichnen den Wertverlust von Vermögenswerten, z. B. von gebrauchten Maschinen, die im Laufe der Zeit veraltet sind

- Zinsen sind Kosten für Schulden. Die Schulden werden in der Bilanzierung aufgeführt

- Steuern werden auf den EBT gezahlt

Bestimme bestimmte Kennzahlen und verfolge sie im Laufe der Zeit, um Erkenntnisse zu gewinnen

Die Gewinn- und Verlustrechnung ist ein hervorragendes Instrument, um die Profitabilität eines Unternehmens zu ermitteln. Die Vielfalt der möglichen Rentabilitätskennzahlen ermöglicht eine tiefere Analyse und einen Vergleich von Unternehmen (siehe Benchmarking).

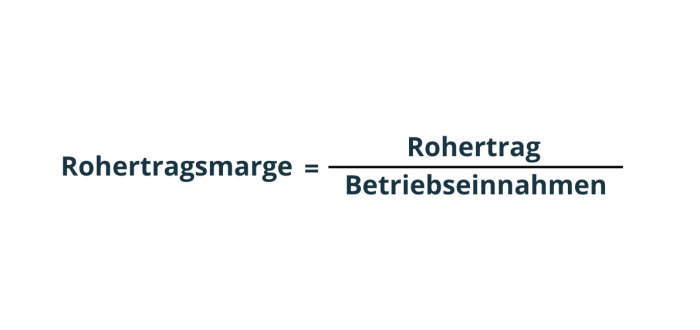

Die Rohertragsmarge gibt die Rentabilität des reinen Kerngeschäfts an, wobei nur die Betriebseinnahmen, die Herstellungskosten und das SG&A berücksichtigt werden.

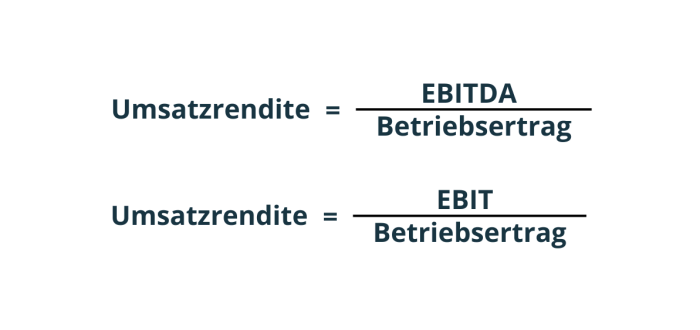

Bei der Umsatzrendite werden die nicht-operativen Kosten und Einnahmen berücksichtigt. Auch die Abschreibungen können einbezogen werden, da sie insbesondere in anlagenintensiven Branchen eng mit dem Geschäft eines Unternehmens verbunden sind.

Die Gewinnspanne berücksichtigt alle Kosten, auch Zinsen und Steuern.

Wenn die Gewinnspanne unterschiedlich, die Umsatzrendite aber gleich ist, kannst Du daraus schließen, dass die Abweichung nicht direkt auf das Kerngeschäft zurückzuführen ist, sondern eher auf Unterschiede bei den Steuer- und Zinszahlungen. Wenn Du Gewinn- und Verlustrechnungen aus aufeinanderfolgenden Jahren vergleichst, erkennst Du verdächtige Trends, die für die Lösung eines Cases hilfreich sein können. Die Kostengliederung einer Gewinn- und Verlustrechnung ist MECE und kann bei der Lösung eines Profitabilitäts-Case als Problembaum verwendet werden.

Die wichtigsten Schlussfolgerungen

- Eine Gewinn- und Verlustrechnung gibt einen Überblick über die Einnahmen und Ausgaben eines bestimmten Zeitraums

- Gewinn- und Verlustrechnungen geben einen Überblick über die Erträge und Kosten zum Zeitpunkt der Abgrenzung