Net Present Value (NPV) – Definition, Examples, And How to Calculate It

Definition of the Net Present Value (NPV)

The net present value (NPV) allows you to evaluate future cash flows based on the present value of money. It is the sum of present values of money in different future points in time. The present value (PV) determines how much future money is worth today. Based on the net present valuation, we can compare a set of projects/ investments with different cash flows over time. This enables us to quantitatively assess a business' attractiveness using a benchmarking of NPVs.

Time Value of Money – An Intuitive and Financial Explanation

The closer future cash flows are to the present, the more valuable your money is. The concept is also known as the time value of money and we provide two explanations below:

- An intuitive explanation: People will prefer money at present because of risk aversion. Would you rather have $100 today or in a year? Obviously today, because there is a risk that you may not get that $100 in a year. In addition, once you have the money, you again have a decision to either spend right away or wait to spend

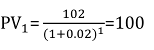

- A financial explanation: Imagine you have $100. How much is it worth in a year? If you do not leave the money in your pocket, you usually have the option to put the money in your bank account at low and almost negligible risk. You will earn interest but may lose value due to inflation. However, the inflation-adjusted interest rate may be 2%, in absolute terms $2. In total your $100 is worth $102 after one year. Now, you can calculate backwards: If you have a future value of $102 in a year, how much is it worth today? It is $102 divided by 1.02 which results in $100 again.

How to Calculate The Net Present Value (NPV)

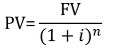

- PV is the present value

- FV is the future value

- it is the decimal value of the interest rate for a specific period

- n is the number of periods between present and future

The following is the calculation of the above PV example with $102 future value at an interest rate of 2%,

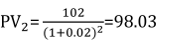

Below, you can find a slightly different version of the above example, in which you receive $102 in two years instead of next year. The two-year investment earns you a theoretical interest two times, which is why you discount twice.

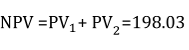

The Net Present Value of those two $102 payments in one and two years is simply its sum.

Apply NPV Shortcuts to Succeed in Case Situations

It’s unlikely that you will need to calculate a complex NPV during a case interview because the calculations tend to get overly complicated. But in some cases you can apply some shortcuts as discussed below:

1. Perpetuity: the NPV for infinite cash flows (meaning business will generate profits for an infinite period of time)

For infinite cash flows, there is a simplified formula:

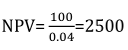

Imagine you have to value a company in a case interview. A common approach is to define the value of a company as the sum of all its discounted future profits. If you assume that a company will have the same profits every year for an indefinite time horizon, you just divide the future value of all profits by the respective discount rate. For instance, if you expect the company to yield $100 every year, the company is worth $2500 (at a discount rate of 4%).

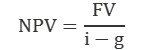

To make this more pragmatic, you could assume that the company's profits will grow every year at a certain rate, g.

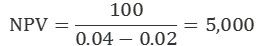

Especially for short-term horizons, defining expected growth is difficult. An approximated growth rate for profits that are far into the future is often around 2%. After a while, every business or product life cycle ends up in a competitive market environment and simply grows at the same rate as the overall economy. The above example recalculated with a continuous growth rate of 2% results in a net present value of $5000 for the company.

Notice that the value is twice the value compared to the calculations without a growth. NPV calculations are very sensitive towards changes in inputs. Therefore, a sensitivity analysis is conducted in most cases. To do so, you need to create a range of possible NPVs by using a range of possible growth and discount rates.

2. Find the right interest rate

Finding the correct discounting factor for NPV calculations is the business of entire banking departments. In general, there is one basic rule: the bigger the risk, the higher the discount rate.

The rationale behind this rule is simple: The less you can be sure about receiving future earnings, the less you value them. By increasing the discount rate, the NPV of future earnings will shrink. Discount rates for quite secure cash-streams vary between 1% and 3%, but for most companies, you use a discount rate between 4% - 10%, and for speculative start-up investment, the applied interest rate could reach up to 40%. In case interviews, you could ask for the discount rate directly or estimate it at 10% for most scenarios if the interviewer requests you to approximate it.

Why Is The NPV Used By Companies?

The NPV is a strong indicator for companies to determine whether a project is profitable or not. As it considers the interest rate and inflation rate (which are usually equal to one another), the real value of money at every year of the project can be considered. If the calculated NPV is positive, the company can argue that the project or investment will be profitable since the earnings generated exceed the costs, all calculated in the present value of dollars. On the other side, if the calculated NPV is negative, it is an indicator for a company to step back from an investment o project since it will result in a net loss. Thus, the NPV can be a valuable tool for companies to evaluate whether to invest in a project or not.

Advantages of The Net Present Value

Net Present Value (NPV) offers many advantages, all of which relate to the accuracy of the calculation in determining the actual value of a future amount of money under present conditions. The measurement is based on the time value of money theory, which indicates that a given amount of money is worth more now than the same amount of money in the future. Inflation rates and the rates at which invested money can grow in the future combine to form a discount rate that devalues future money. Because the discount rate is considered in the calculation, one of the main advantages of NPV is that it allows important financial decisions to be made. Business decisions are difficult to make at any scale, from deciding on a key purchase to deciding on a costly new project. It can be foolish to make these decisions without first considering the impact of time on money. For this reason, a calculation that takes into account the relationship between time and money, which is one of the main advantages of NPV, is critical.

The perhaps most important advantage of the present value is its usefulness in a business decision. Once the NPV is calculated, the company making the decision needs to only compare current costs with the NPV. For example, a company that has the opportunity to purchase a new factory for $100,000 (USD) should only proceed with the purchase if the present value of future cash flows is greater than $100,000. Otherwise, it would be better for the company to invest the money elsewhere.

Limitations of The Net Present Value

In practice, the concept of net present value is common and is used oftentimes. Nevertheless, there are disadvantages and limitations of this key figure. For example, the calculated value is based on various assumptions. If one or more assumptions do not materialize in practice, the net present value and the actual benefit of an investment may differ. At the same time, the concept is susceptible to influence by the valuer. Individual assumptions can theoretically be changed until the result matches the expectations of the valuer. Consequently, the net present value has the highest informative value when an investor calculates it himself.

Example: A company examines the benefits of investing in a new production line. The company assumes that the machine will be used for ten years and consequently plans with ten periods to determine the net present value. However, after seven years, customers no longer demand the product that has been produced. The production line has to be discarded in favor of a new machine. The originally calculated net present value is significantly lower than originally assumed due to the change in the utilization period.

Although the net present value is a comprehensive concept, the secondary effects of an investment are not taken into account. The cash flow series used relates directly to the investment examined. The net present value cannot measure synergy effects in other parts of the company or, for example, an improved corporate image.

Key Takeaways

- Use NPVs to evaluate future cash-flows in today’s time value of money

- By calculating risk-adjusted NPVs, you can quantitatively compare different investments

- NPVs are used to value a company based on its future profits

- The NPV does not take into account secondary effects of an investment