The cash flow statement gives an overview of a firm’s ability to generate cash

The cash flow statement belongs to one of the three financial statements in addition to the balance sheet and income statement. Cash flow statements show the inflow/outflow of cash. The key difference between a cash flow statement and an income statement is that while an item gets listed in the income statement as soon as it is accrued, the same item gets listed in the cash-flow statement only after the actual payment has happened.

Cash flows can be segmented into three major categories:

- Operating cash flows are a result of the core business in which cash flows are directly generated by manufacturing or selling a product. These are necessary to keep the business operating.

- Investment cash flows are long-term investments into assets such as property or plants.

- Financing cash flows are a result of activities such as issuance and repurchase of bonds, equity, and dividends.

Cash flow, balance sheet, and financial statement are interdependent

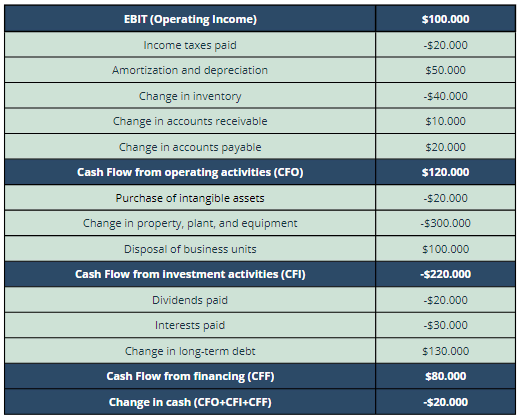

The income statement is used to derive the operating cash flow:

- In general, you start with EBIT. All included positions that have no actual influence on cash flows are subtracted. For example: to derive the earnings before interest and taxes (EBIT), depreciation is subtracted from the gross profit. Since depreciation is not actual cash flow, it has to be added again to get a true picture of a firm’s cash flow. Likewise, positions that are not included in EBIT, but result in changes in cash flow need to be added, e.g. taxes.

The balance sheets from two consecutive years are used to derive the investment and financing cash flow:

- Determine the investment cash flow over the asset side of the balance sheet: If assets increase due to investments over the past year, cash-outflows are necessary to acquire them. Likewise, if assets such as inventory decrease, they result in cash inflows from sales.

- Use the financing side of the balance sheet to derive the financing cash flow. If equity or liabilities increase a cash inflow must have happened. Of course, you can buy assets immediately through debts meaning that the cash from getting credit is directly used for the asset. Consequently, cash flows possibly cancel each other out.

The sum of all three cash flows (operating, investment and financing) is the final change in cash. You can find this change in the balance sheet as the difference in cash positions between the current and preceding year.

Find below an example of how these three cash flow types can be indirectly calculated

Cash flows are major inputs for company valuations

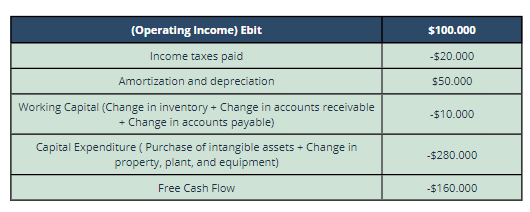

Free cash flow is another type of cash flow important for investors. It depicts the amount of cash that can flow to a company’s security holders in terms of dividends or interests without extracting necessary money for daily operations. Free cash flows are often used to determine the company value by applying discounting principles.

Calculations can be done in several different ways. But the key idea remains the same: from a company’s income, add everything that has been subtracted during profit and loss calculation that has no real influence on the level of cash. Subtract everything that is needed as an investment to keep the business running at a current level. This is usually working capital, or current receivables, payables, and capital expenditure (e.g., investments in plants, property, and equipment), which have to be renewed.

Key takeaways

- Cash flows are crucial to determine liquidity. Positive cash flows are a sign of at least short-term solvency.

- Cash flow emerges from operations, investing, and financing.

- Operating cash flows help to assess the company's ability to fund the ongoing business.

- Cash flow from investing helps to assess the possibilities of future growth through investments.